Accounts Receivable Management Solutions

RetailStat Payment Scoring & Private Company Information

Gain comprehensive credit insights with RetailStat’s payment scoring and private company data powered by the industry’s leading trade database.

RetailStat's Financial API is Here ⭐ Delivering seamless access to financial and proprietary credit data directly into your workflows—no extra logins, no wasted time. Our API includes exclusive trade data, proprietary credit scores, and financial insights on 25K+ companies. Connect with our team to implement the Financial API today! Get Started

Gain comprehensive credit insights with RetailStat’s payment scoring and private company data powered by the industry’s leading trade database.

Data and resources designed to fit your business. Make informed credit decisions and mitigate risk with unparalleled access to industry-specific supplier payment history, proprietary payment scores and other private company information.

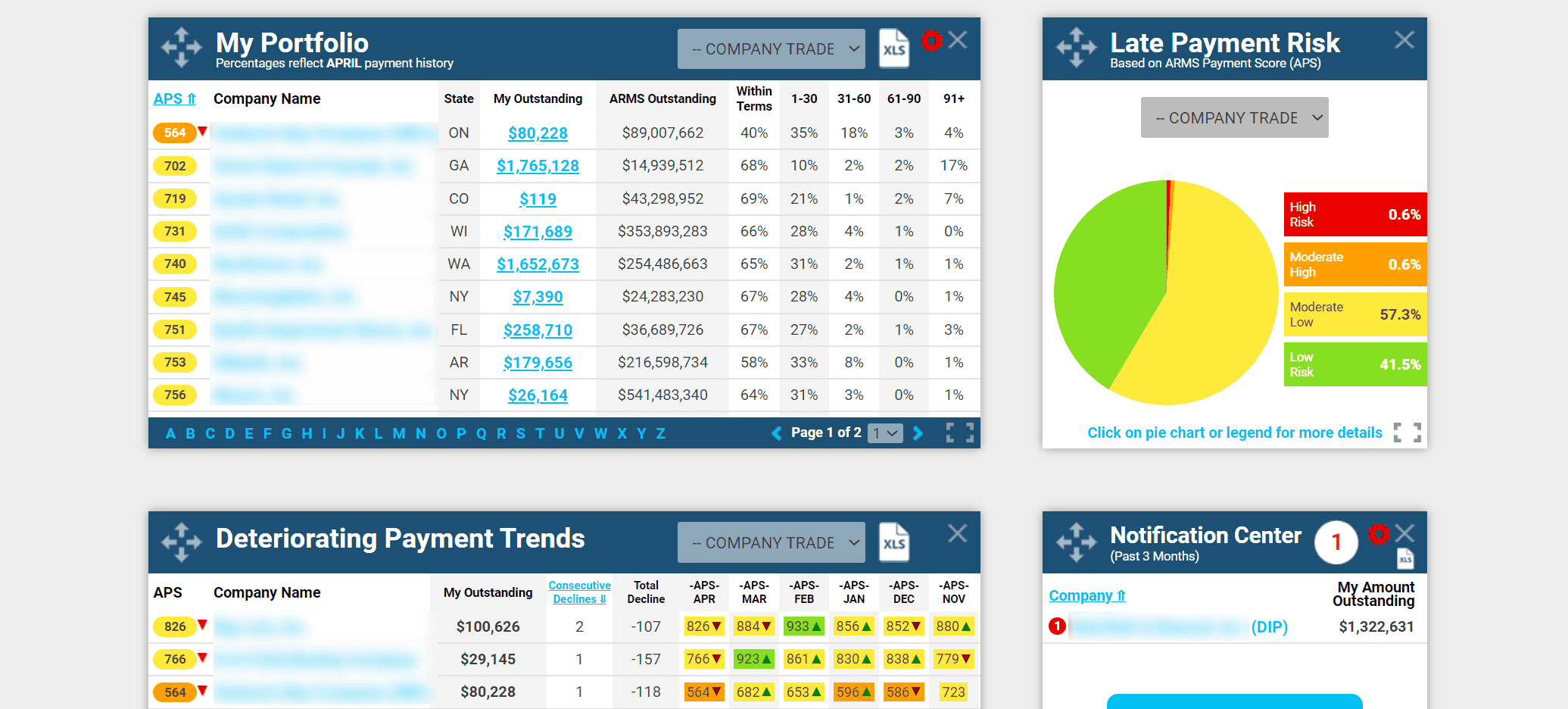

The answer to your receivable management challenges is here. Quickly identify companies at risk with our Credit Intelligent Dashboard, which provides a suite of customized widgets and proprietary, predictive measuring tools created by our team of seasoned credit professionals.

A comprehensive database of over 30,000 company credit files from 20 industry segments using the highest quality, accurate credit data. Credit files include: company background information, robust trade payment data & scoring, derogatory legal data, UCC/banking information, store closings, bankruptcy information and more.

Want a quick and easy way to understand your customers’ payment trends and how it affects your overall payment risk? Our proprietary ARMS Payment Score (APS) gives a snapshot into a company’s payment behavior allowing you to assess health and risk in your portfolio. Deteriorating Payment Trend analysis ensures you are aware and ahead of slow paying accounts.

Get access to a daily feed of Chapter 11 bankruptcy information and a bi-annual, in-depth review of industry filings. Protect your business by reacting quickly to customer bankruptcies with both our daily bankruptcy publication and portfolio-driven alert service.

With an average of 15 years of retail credit experience, our credit investigation team is available to assist in investigating and researching your privately held customers.

Go paperless. Save time and resources by managing the entire credit application and customer onboarding process from a single interface. Our portal includes customizable applications to match your current paper application allowing you to send and receive trade and bank references electronically for a fully automated, efficient process.

Whether you need to act fast on bankruptcy filings, weed out high-risk customers or tenants or protect yourself against financial and credit risk, we have the reliable insights you need, right on time.